Editor-in-Chief Prof. Badria A. Al-Awadi

No sooner had the world of business and economics digested the crisis enveloping German automaker Volkswagen, which admitted manipulating the emissions software in seven models of its cars, than a new scandal broke in Japan. This time, it is a scandal involving Mitsubishi, one of the famous Japanese automakers. It has recently been reported that Mitsubishi lied about the fuel economy data on its cars that affects models dating back to 1991. Mileage fraud is a violation of Japan’s fuel efficiency law. Investigations are on-going and the full extent of the scandal is yet to be revealed. What is clear is that these stories have generated a quite astonishing global shock about the practices and dealings of trusted automakers, the negative effects of which will certainly emerge successively on the economic, social and financial levels.

There is no doubt that the two above-mentioned examples of the acts and behaviour of companies and their directors reflect multi-faceted administrative, economic, regulatory, governmental, societal and ethical crises. They also reflect the crisis of the standards of governance, oversight and follow-up systems on the part of regulators, which has been the subject of heated debate since the crises of US and global companies and markets in the 1990’s. Nevertheless, the effectiveness of the response to these crises seems inadequate, necessitating revisiting the debate over regulation. There is no doubt that Arab companies and financial markets have suffered from, and continue to suffer from, a similar phenomenon, if not more severe, as a result of globalization. The problems in the Arab context include everything from budget and trade imbalances, to deficiencies, corruption, limited performance and control, as well as concerns over transparency and integrity. All of these issues underline the need for new strategies and dynamic solutions.

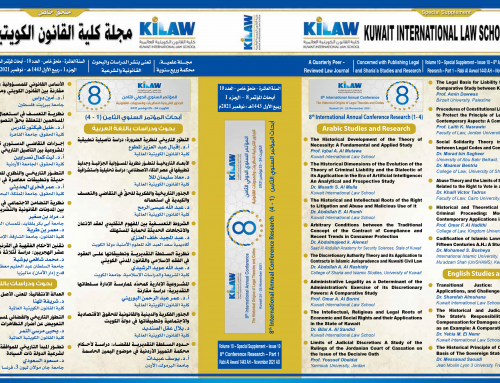

In this light, the issues and challenges of governance and capital markets in the legal sphere gain increased importance and momentum. This has prompted the Kuwait International Law School to devote its Third Annual Scientific Conference to discuss the issue of “Challenges of Governance and Capital Markets Regulation”. More than 80 intellectuals and scholars from within Kuwait and beyond applied to participate in the conference. After review, forty applicants were selected and they will present 37 papers. This reflects the increasing importance of the topic for Arab and foreign elites. It also reflects the growing confidence in Kuwait International Law School as a platform for academics to discuss and develop jurisprudence concerning emerging issues.

For its part, in the context of its support for the conference, and given that the papers presented are refereed and subject to its publication standards, the Journal of the Kuwait International Law School has decided to issue a special two-part supplement containing the presented papers. The first part includes 20 papers and will be distributed during the conference, and the second will be issued in September and will include the remaining papers. The purpose of this special 2-part issue is to help the Journal achieve its objective of disseminating and promoting scientific research in the Arab and international legal and scientific circles.

On this occasion, whilst warmly welcoming intellectuals and researchers who are participating in the conference, the Kuwait International Law School Journal renews its call for them and for all Arab and foreign academics to publish their research on its pages across various legal topics.